The TEFFI Act enables the creation of regulated trust companies for alternative asset financing, custodial and asset management organizations known as TEFFIs within the State of Kansas.

The TEFFI Act is designed to expand Kansas’s banking industry through the chartering of trust companies to provide financing to investors and managers of alternative investments from across the nation. The new charter allows Ben to serve as a regulated fiduciary providing liquidity, custodial and administrative services to alternative asset investors.

For Ben, our unique charter structure is paramount to being able to operate with the highest standards of trust and integrity on behalf of our customers who entrust us to provide them long-term fiduciary services, liquidity solutions and other asset management services for their alternative assets. While our regulatory charter under the TEFFI laws of Kansas is new to Ben, it is just one of Ben’s many competitive strengths that differentiates our fiduciary services for our customers and clients.” – Brad Heppner, Ben CEO and Chairman

The TEFFI Act received unanimous support in the Kansas Senate and strong bipartisan support in the House. By engaging all stakeholders, Kansas lawmakers passed common sense legislation for the benefit of alternative asset owners, the industry, and – importantly – local economic development zones throughout Kansas.

How It Works

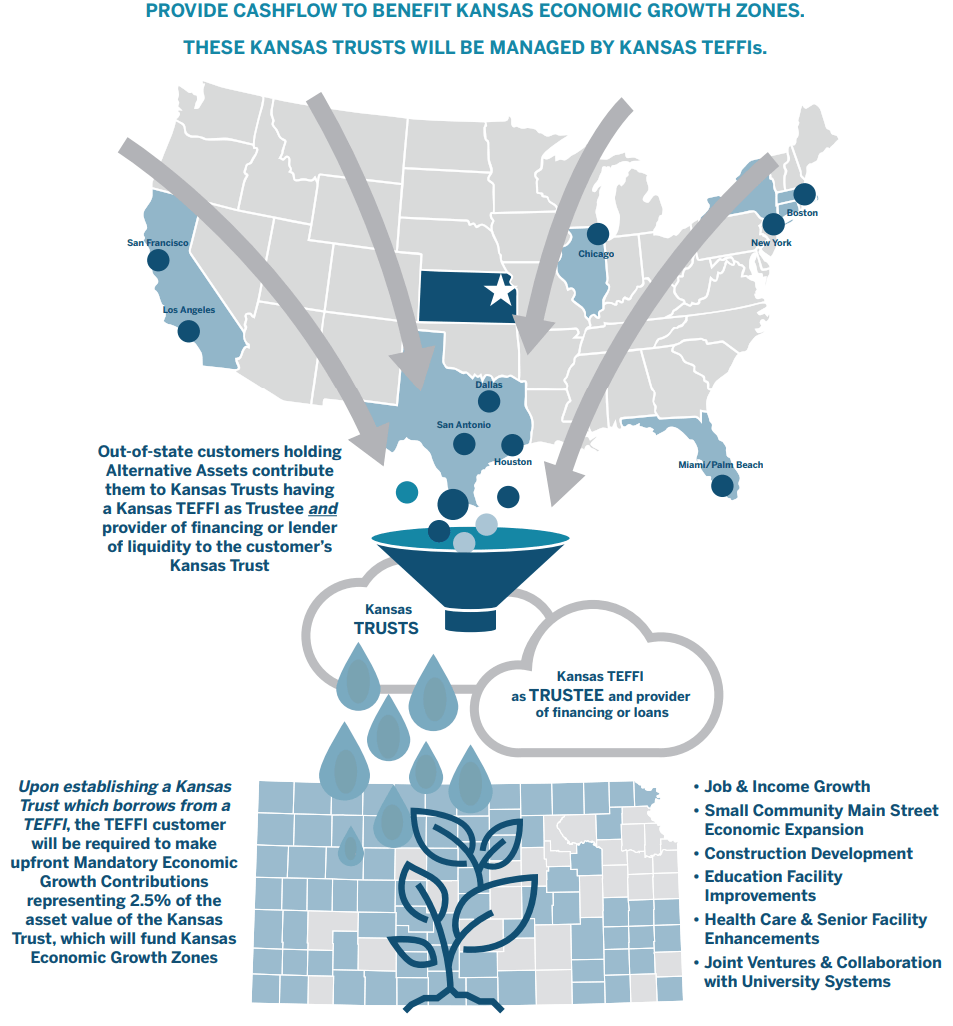

The new law will ensure that companies who provide liquidity for alternative assets have the ability to fully operate within the U.S., while also benefitting communities throughout Kansas.

As long as trusts are established in Kansas to hold alternative assets for investors from across the country and a Kansas TEFFI trust bank provides financing to the trusts, then economic benefits will flow to those local communities.