Key Macroeconomic Themes

In this second-quarter update to our global macroeconomic outlook, developed in partnership with Oxford Economics, we highlight the precarious and potentially high-risk economic environment stemming from tightening financial conditions and monetary policy, and the shaky resilience of certain economic indicators. This report highlights three key themes in the global economy that are shaping our outlook:

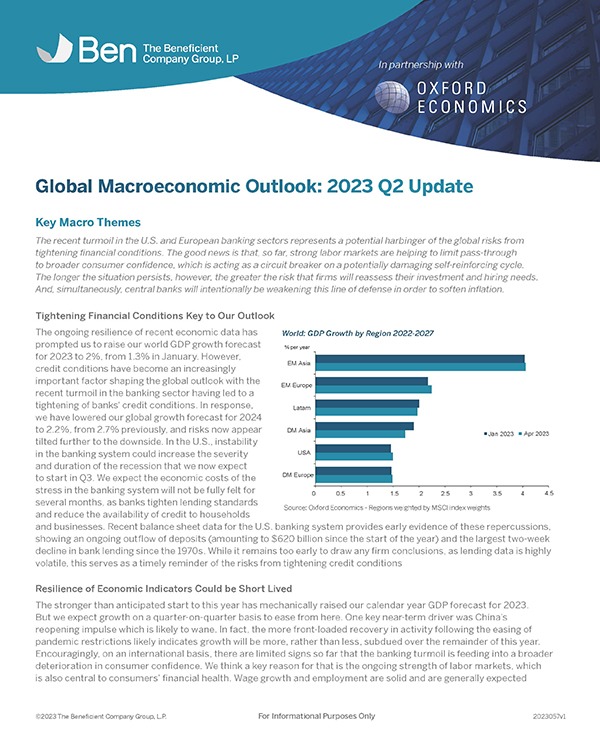

- Tightening Financial Conditions. Despite a bump in our forecast for world GDP growth, banking chaos in the U.S. and Europe and the resulting tightening of credit conditions could continue to cascade through the year.

- Labor Market Resilience. Labor market resilience is key to consumer confidence and financial health as wage growth and employment remain solid despite a likely easing of growth on a quarter-on-quarter basis.

- Tightening Monetary Policy. Inflation remains high, leading to expected additional rate hikes, but policymakers face a balancing act between over-tightening and prolonged inflation.

We suspect that these forces could lead to a period of low growth and high uncertainty marked by long-term inflation expectations in the U.S. and globally, as well as a subdued economic recovery in subsequent years. Click the “Download the Update” button to read the full quarterly report.

Our Market & Private Allocations Forecast

Our quarterly updates provide medium-term forecasts for key public and private market segments, allocation tilts across private alternatives as well as our perspective on current market risks. On the public market front, real estate sector is forecasted to outperform in part due to recent corrections. Private equity funds are also expected to outperform while remaining short of matching the performance of the past 20 years. Our risk scenario of persistent high inflation and resulting asset price crash shows that technology stocks are still highly vulnerable despite recent trends, while real estate sector shows good medium-term resiliency.

Important Disclosures

The information in this material is not intended to replace any information or consultation provided by a financial advisor or other professional nor shall be perceived to constitute financial, legal, accounting or tax advice.

The views and opinions expressed are those of the panelists and do not necessarily reflect the official policy or position of Ben or Oxford Economics. The information in this material is not intended to replace any information or consultation provided by a financial advisor or other professional nor shall be perceived to constitute financial, legal, accounting or tax advice.

These materials contain certain estimates, projections and forward-looking statements that contain substantial risks and uncertainties. The estimates, projections and forward-looking statements contained herein may or may not be realized, accurate or complete, and differences between estimated results and those realized may be material. Such estimates, projections and forward-looking statements are illustrative only and reflect various assumptions of Ben’s management concerning the future performance of Ben and its affiliates, and are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Ben’s control.

Except as otherwise noted, the materials speak as of 2023. Neither Ben nor any of its affiliates or representatives undertakes any obligation to update or revise any of the information contained herein or to correct any inaccuracies which may become apparent.