The conventional wisdom is that most investors want to get as much out of their investments as possible to pay for their lives’ financial and personal events: retirement, college for their kids and, sadly, a divorce from their spouses or their estates when they die.

But a class of nimble investors who have different plans for their investing dollars is growing. These investors have turned away from the public markets to invest in alternative assets to increase their returns. When these investors want to seek liquidity for alternative assets, they are most interested in putting their investments to work in a better performing alternative.

Liquidity as a Pathway to Investing Opportunity

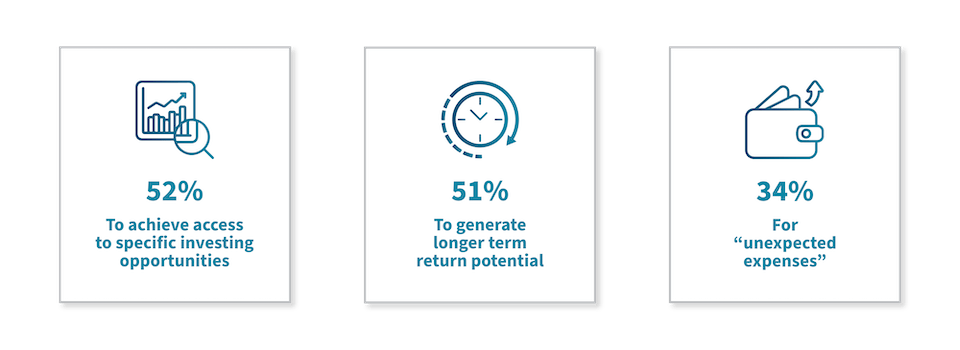

That was the surprising finding of Beneficient’s The Ben Liquidity Report™: Alternative Asset Investors, Their Behaviors and Wealth Attitudes which surveyed 600 mid-to-high net worth (MHNW) individual investors holding alternative investments. The survey found that only 9% of respondents said they sought to get out of their alternative assets for “life events, such as death or divorce.” Instead, the three primary reasons chosen by those surveyed said a lot about why they invested in them in the first place:

This turns the conventional wisdom on its head and reveals that investors holding alternative investments are not a common breed who would be attracted to a buy-and-hold strategy for their nest eggs. They want to be able to get out of the alternative assets without much cost or friction to be able to pursue better opportunities and higher returns.

This result fits with the growth in MHNW investors turning to alternative assets as markets have become increasingly correlated. To break out of lock-stepped returns from public companies and the low-yield bond market of the last 15 years, investors have had to seek out other assets including private equity, real estate and other structured products.

“The survey’s findings tell the story of a new emerging demand for liquidity among MHNW alternative assets investors,” The Ben Liquidity Report found. “If the motivations behind seeking liquidity are opportunity-driven, then it makes sense that investors place more importance on investment security-based forms of consideration and upside potential than cash.”

The Growing Global Appetite for Alternatives

Preqin found that worldwide alternative assets totaled more than $11 trillion in 2021. By 2025, Preqin projects it will exceed $17.2 trillion. That still lags behind publicly traded stocks at $53 trillion in total assets at the end of last year, but the growth rate of alternatives will far exceed that of publicly traded stocks and bonds.

While the market for alts has continued to grow, the infrastructure for getting them out of the investments has not caught up with the demand. Those surveyed for The Ben Liquidity Report are the type of investor who can’t afford the high cost of traditional liquidity – the MHNW investor and small-to-mid-sized institution who don’t have enough invested to be able to pay the cost of the firms specializing in providing them liquidity when they need it.

The survey reveals a huge opportunity for wealth managers, financial advisors, sponsor firms, and other intermediaries to improve access to liquidity solutions that deliver on MHNW investor preferences. As allocation to alternatives grows, due in part to the technology-enabled democratization of access to this asset class, so does interest in liquidity.

Trust Ben™

At Ben, we have crafted a suite of reliable, ongoing liquidity solutions for investors in alternative assets. Our process seeks to give investors access to hard-earned investment capital, with liquidity provided from our own balance sheet. Contact us today to schedule a consultation with our expert team.

Download the full The Ben Liquidity Report to read more about the attitudes, behaviors and liquidity needs of mid-to-high net worth U.S. alternative asset investors. Contact us today to discuss what Ben’s secondary market liquidity solutions could mean for you.

CONTACT INFO

CALL: 888.887.8786

EMAIL: askben@beneficient.com