Welcome to the next part in a series drawn from Ben’s latest global macroeconomic outlook, Geographic Diversification in Private Equity Markets, developed and written in partnership with Oxford Economics.

In our previous article, our analysis suggested that some non-U.S. markets offer potentially large relative returns over the coming years. However, U.S. private equity returns are forecast to be among the lowest across global regions. A major risk factor relating to returns in non-U.S. markets, and one which can dampen appetite for them, is exchange rate risk. In this article, we’ll explore the historical volatility of the dollar, salient factors contributing to the strength of the dollar, and what that means for minimizing investment risk.

Dollar Volatility

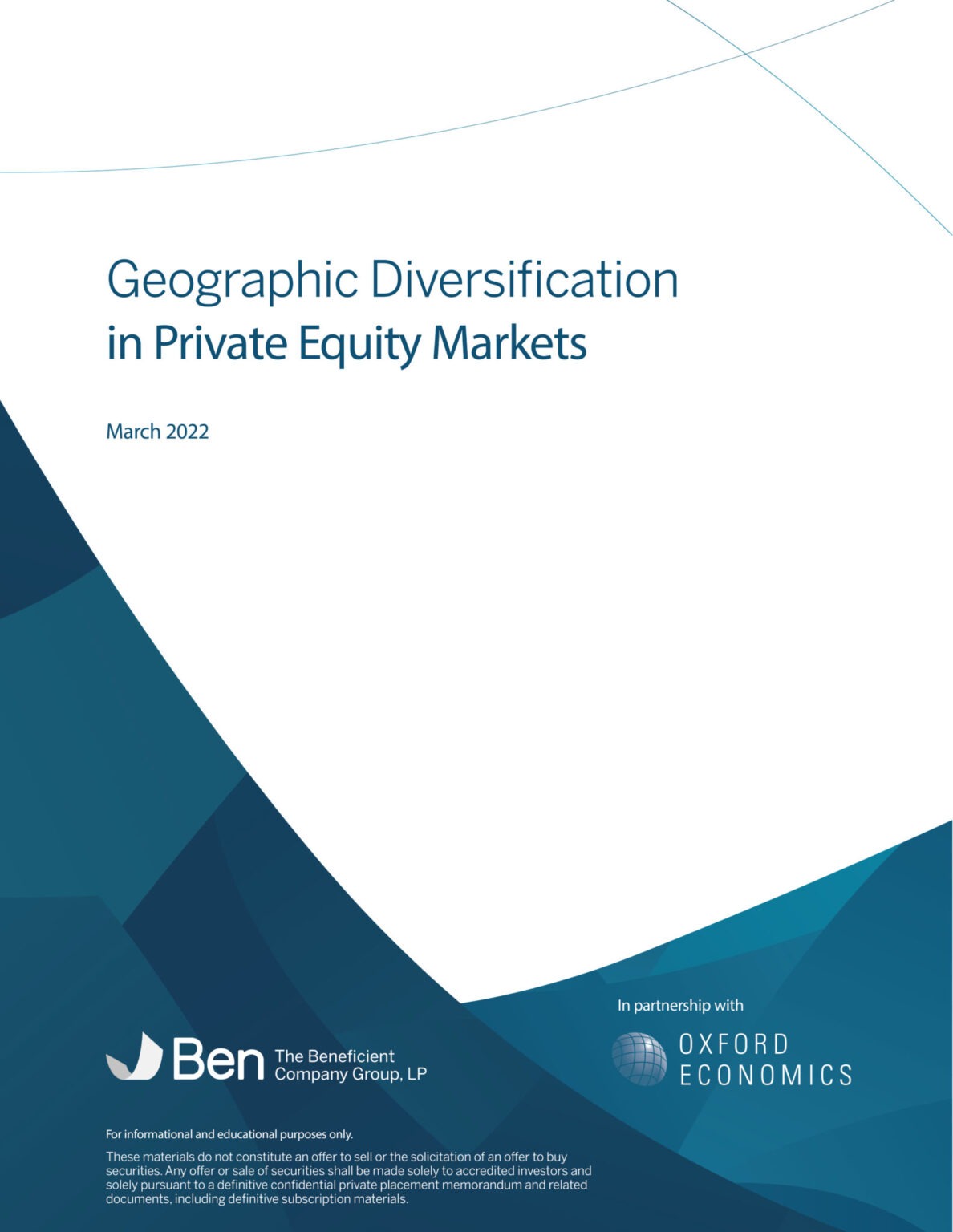

The dollar tends to move in long swings that can amplify or wipe out returns from non-dollar markets and add substantially to their volatility. Three times over the last fifty years, the dollar’s real effective exchange rate has appreciated by over 25% in the space of a few years and three times it has depreciated by 25%-30%. Dollar moves can also be rapid, especially when associated with big shifts in global risk appetite (Figure 1).

The dollar has been relatively strong on a trade-weighted basis since 2014. In two phases, it gained over 30% from mid-2014 to early 2020. Even with some weakening since then, the real effective exchange rate is still above its long-term level, which implies some weakening is likely in the medium-term. Our baseline forecasts reflect this to an extent, with a gentle trend of dollar depreciation seen to 2025.

Long-Term Strength of the Dollar

Despite its volatility, several important factors support the strength of the dollar. The dollar’s importance as a currency for the invoicing of global trade and its dominant position in international financial market use (e.g., for bond issuance, FX reserve holdings and cross-border transactions) are undimmed. The size, liquidity and security of U.S. financial markets continue to attract inflows from around the world.

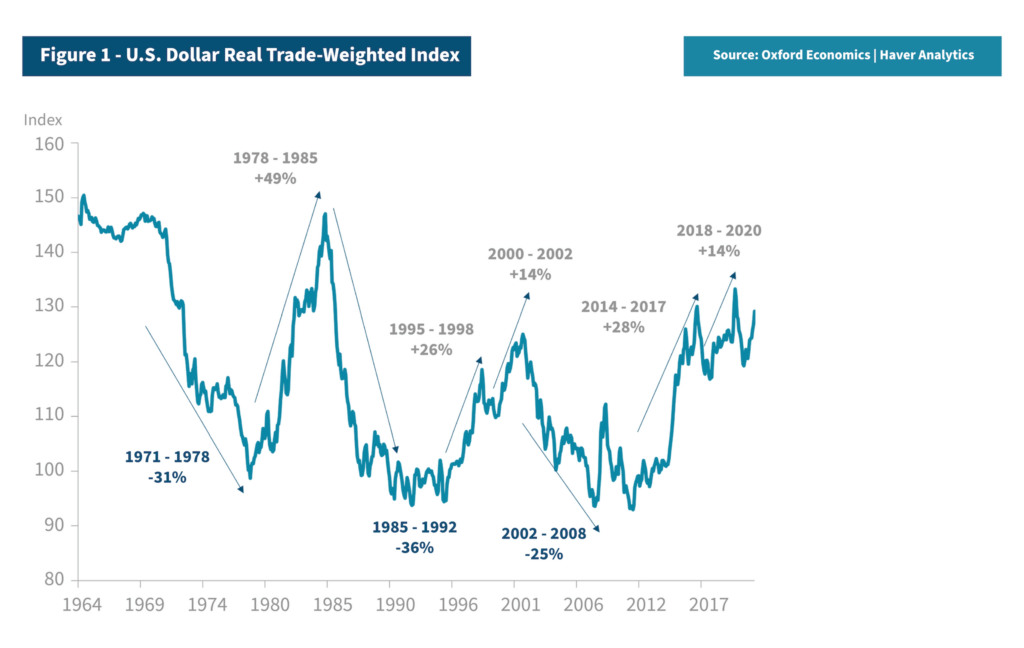

FX risks are also a major consideration for investors thinking about diversifying into emerging markets. Emerging currencies have been on a weakening trend in recent years and have also shown significant volatility (Figure 2), a fact which be considered when selecting portfolio allocations. It is worth noting that some markets cannot reliably be modeled or easily accessed, because of their low transparency, illiquidity, or political instability. For those reasons, we generally exclude such countries from our geographic regions (e.g., Argentina, Venezuela, Pakistan, etc.).

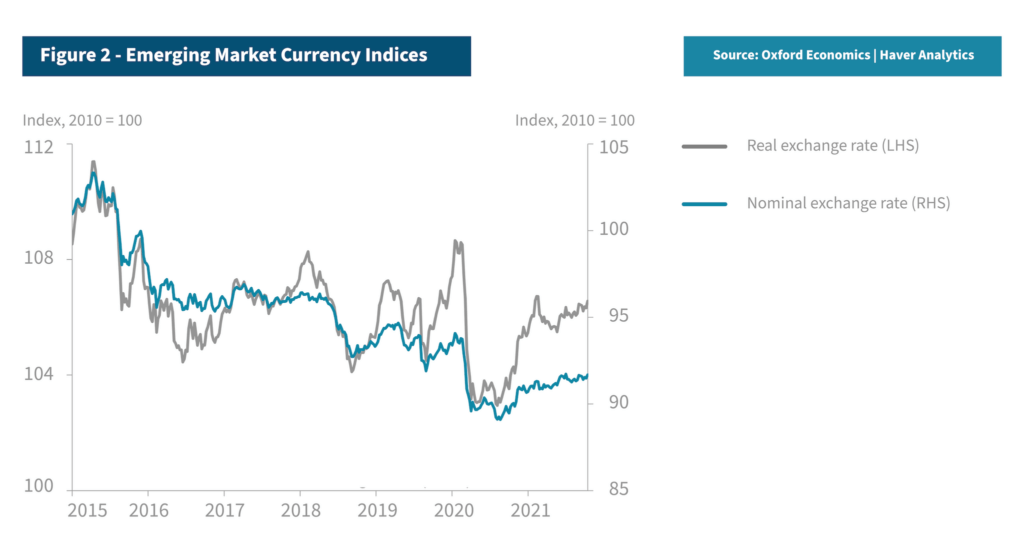

Our FX forecasts over the next five years show considerable variation across regions. We assume the dollar could weaken modestly on a trade-weighted basis from its currently relatively strong level. The biggest gainers would potentially be currencies in developed Asia and developed Europe, with smaller gains in developing Asia; the losers emerging Europe (chiefly, Russia and Turkey) and Latin America – continuing the latter region’s recent history of significant volatility (Figure 3).

Conclusion

Foreign Exchange (FX) risk represents a significant hurdle to investing outside the U.S. The dollar can move in long swings that magnify non-dollar returns and add substantially to their downside risk. The outlook for the dollar remains highly uncertain. Although it is strong on an historical basis and relative to some fundamental anchors, its ongoing position as the reserve currency and the depth of its capital markets are important supportive factors.

Trust Ben™

At Ben, we have crafted a suite of reliable, ongoing liquidity solutions for investors in alternative assets. Our process seeks to give investors access to hard-earned investment capital, with liquidity provided from our own balance sheet. Contact us today to schedule a consultation with our expert team.

The information in this material is not intended to replace any information or consultation provided by a financial advisor or other professional nor shall be perceived to constitute financial, legal, accounting or tax advice.

The views and opinions expressed are those of the panelists and do not necessarily reflect the official policy or position of Ben or Oxford Economics. The information in this material is not intended to replace any information or consultation provided by a financial advisor or other professional nor shall be perceived to constitute financial, legal, accounting or tax advice.

These materials contain certain estimates, projections and forward-looking statements that contain substantial risks and uncertainties. The estimates, projections and forward-looking statements contained herein may or may not be realized, accurate or complete, and differences between estimated results and those realized may be material. Such estimates, projections and forward-looking statements are illustrative only and reflect various assumptions of Ben’s management concerning the future performance of Ben and its affiliates, and are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Ben’s control.

Except as otherwise noted, the materials speak as of January 2022. Neither Ben nor any of its affiliates or representatives undertakes any obligation to update or revise any of the information contained herein or to correct any inaccuracies which may become apparent.

Download the full Geographic Diversification in Private Equity Markets white paper above or contact us today to discuss what Ben’s secondary market liquidity solutions could mean for you.