Welcome to the third part in a series drawn from Ben’s latest global macroeconomic outlook, Geographic Diversification in Private Equity Markets, developed and written in partnership with Oxford Economics.

In our previous article, we took a region-by-region journey to develop baseline forecasts for global GDP and inflation risk, two key drivers of private equity returns. In this article, we consider the current environment of high valuations in order to develop private market baseline and bear forecasts.

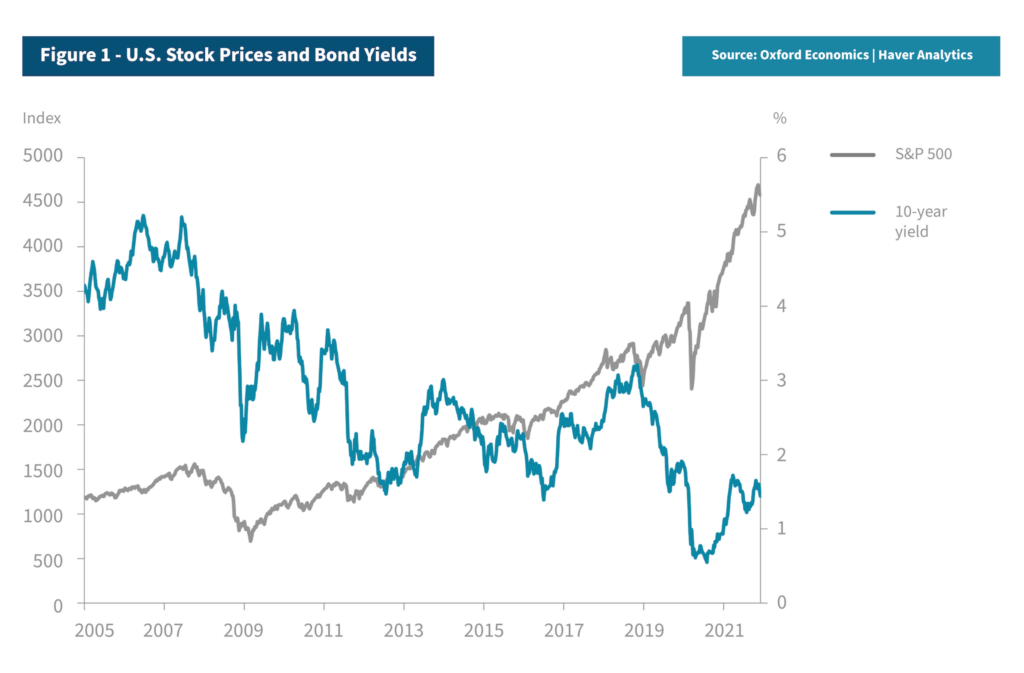

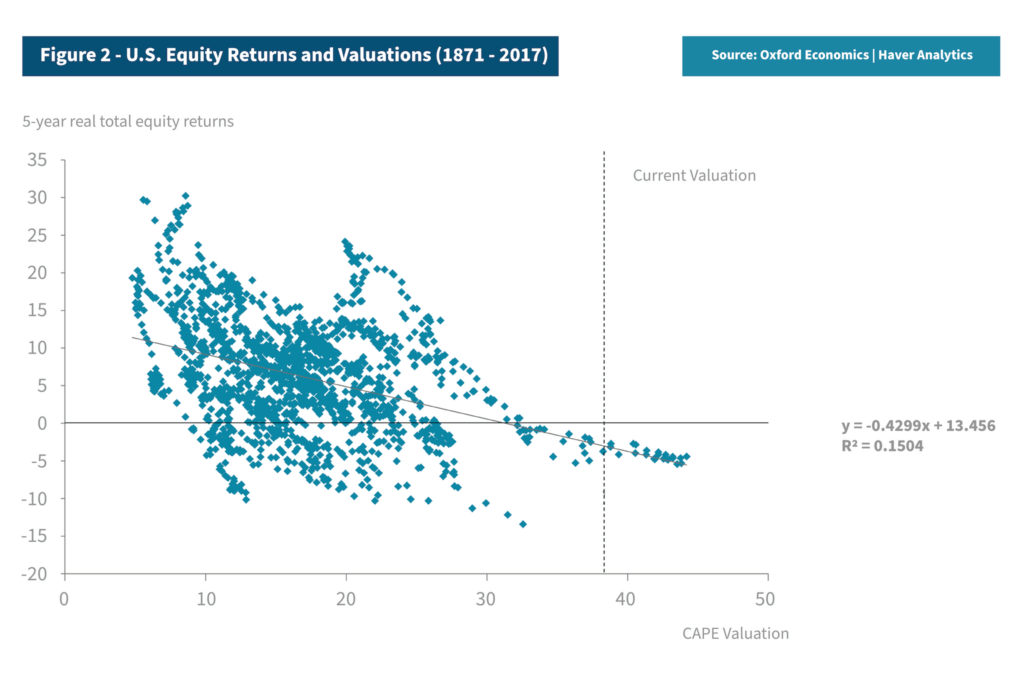

After slumping in March 2020, global public and private equity markets have rallied impressively. This reflects a combination of massive central bank liquidity injections, low interest rates (Figure 1) and economic recoveries. The strong rally in prices has pushed valuations to lofty heights, most strikingly in the U.S. Current cyclically-adjusted valuation levels have only been seen during the dot-com boom and have historically been associated with weak real returns over the following five years (Figure 2).

High valuations are therefore likely to be a headwind for markets in the years ahead and may induce some volatility. The rise in interest rates we forecast over the next few years adds to this risk. Set against this, there are still supportive factors for equity markets such as the high level of unallocated capital or ‘dry powder.’

The Global Macroeconomic Environment: Inflation and Uneven GDP Growth

Our equity price forecasts reflect a balance between high valuations, rising interest rates, robust growth, slightly elevated inflation and high levels of capital on the sidelines. After a more than 30% rise in 2021, we expect U.S. share prices to grow at a much slower pace from 2022-2025, and, as such, global ex-U.S. stocks could experience a significantly slower rise over the same period.

Private Market Forecasts

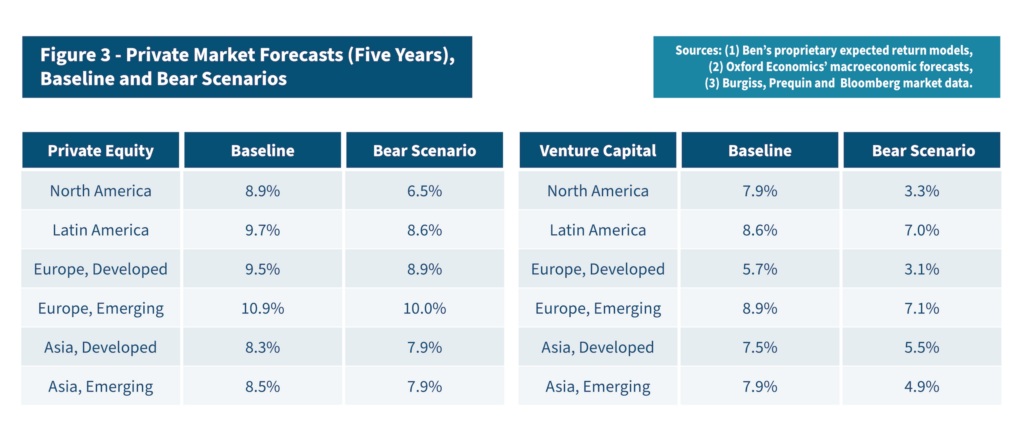

Incorporating broad capital market assumptions into private asset valuation and allocation is an integral part of Ben’s portfolio and risk management. Leveraging macroeconomic forecasts, we develop long-term capital market assumptions (CMA) on a quarterly basis. These assumptions in turn inform proprietary alternative fund models which are tailored to private equity in each major economic region. We focus our analysis on private equity funds as an asset class, but for a fuller picture, we also show our forecasts and geographic allocation tilts for venture capital funds (Figure 3).

Baseline Private Market Forecast

Ben’s baseline forecast envisions a continued normalization of the economy in the wake of the pandemic. As the threat posed by Coronavirus dissipates, consumer and business confidence are expected to return and with it a release of the excess savings accumulated under lockdown. This impetus to growth should help to offset the drag from tightening monetary and fiscal policy. Inflation could remain elevated but will likely fall back closer to inflation targets while remaining above pre-pandemic averages, thanks to tight labor markets and rising wages.

Bear Private Market Forecast

Ben’s bear scenario explores the impact of a marked deterioration in the inflation outlook with consumer prices surging on the back of higher commodity prices, higher inflation expectations and a disappointing recovery in labor market participation. The result is a sharp bond market sell-off, amid heightened expectations of early policy tightening and a correction to equity markets. Global growth slows to 3.1% in 2022 and the pace of recovery disappoints throughout the scenario.

Conclusion

In both scenarios, greater geographical diversification could help investors pursue their financial goals while minimizing their downside risk. The potential for a bout of extended inflation also supports the case for diversification. Inflation risks are higher in the U.S. than elsewhere in the global economy, given the speed of the recovery, and could lead to different correlation structures between asset classes.

Trust Ben™

At Ben, we have crafted a suite of reliable, ongoing liquidity solutions for investors in alternative assets. Our process seeks to give investors access to hard-earned investment capital, with liquidity provided from our own balance sheet. Contact us today to schedule a consultation with our expert team.

1 https://www.bain.com/globalassets/noindex/2021/bain_report_2021-global-private-equity-report.pdf

*The information in this material is not intended to replace any information or consultation provided by a financial advisor or other professional nor shall be perceived to constitute financial, legal, accounting or tax advice.

The views and opinions expressed are those of the panelists and do not necessarily reflect the official policy or position of Ben or Oxford Economics. The information in this material is not intended to replace any information or consultation provided by a financial advisor or other professional nor shall be perceived to constitute financial, legal, accounting or tax advice.

These materials contain certain estimates, projections and forward-looking statements that contain substantial risks and uncertainties. The estimates, projections and forward-looking statements contained herein may or may not be realized, accurate or complete, and differences between estimated results and those realized may be material. Such estimates, projections and forward-looking statements are illustrative only and reflect various assumptions of Ben’s management concerning the future performance of Ben and its affiliates, and are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Ben’s control.

Except as otherwise noted, the materials speak as of January 2022. Neither Ben nor any of its affiliates or representatives undertakes any obligation to update or revise any of the information contained herein or to correct any inaccuracies which may become apparent.

Download the full Geographic Diversification in Private Equity Markets white paper above or contact us today to discuss what Ben’s secondary market liquidity solutions could mean for you.

CONTACT INFO

CALL: 888.887.8786

EMAIL: askben@beneficient.com