Liquidity, while always a critical issue, has come into sharper focus in 2020 amid intense economic uncertainty and profound market volatility. Investors of all kinds are making critical decisions about where to allocate resources, how to fund-or save for-important events, and how all of their assets and liabilities factor into these decisions. This is especially true for owners of alternative assets, where high net worth (HNW) individuals and small-to-mid-sized institutions face unique challenges when it comes to tapping liquidity.

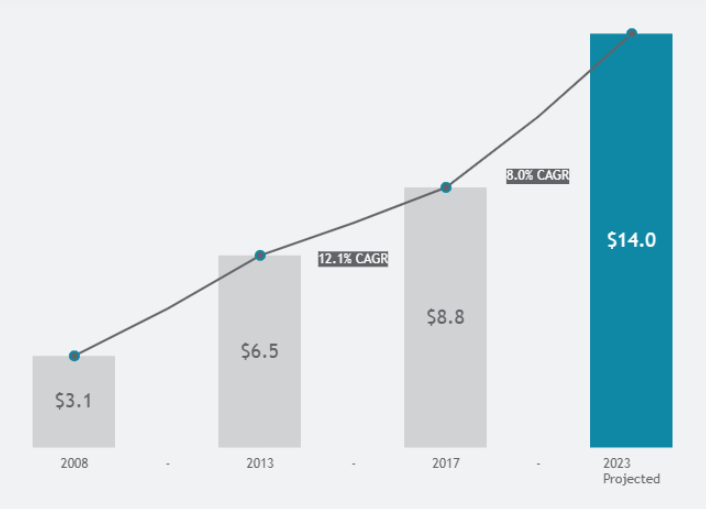

- In 2008, the alternatives market held $3.1 trillion in assets under management globally, according to Preqin.

- One of the main draws was the performance of the Yale endowment model, which held between 40% and 50% of its holdings in alternative assets and saw risk-adjusted returns that significantly beat the broader market.

- By 2017, Preqin estimated that global alternative assets under management had grown to $8.8 trillion, representing a 12.1% compound annual growth rate (CAGR) in the 10 years from 2008.

Global Trends Lead to Increased Utilization of Alternative Investments

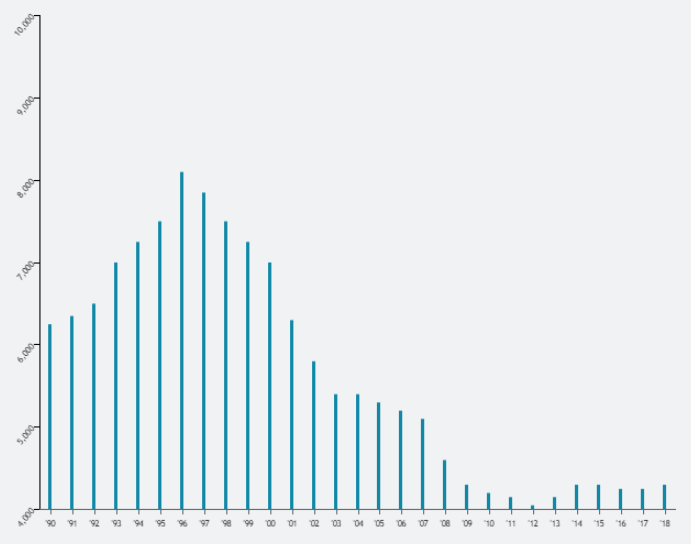

Decline of U.S. Public Companies

The space is growing as the number of publicly listed U.S. companies falls, down 36% since 2000, and down over 45% since its peak in 1996. This decline underscores the concentration of risk in public equity markets and explains why alternative assets have become a critical source of growth and diversification for a wide range of investors-not just large institutions.

Source: The World Bank Group, 2019

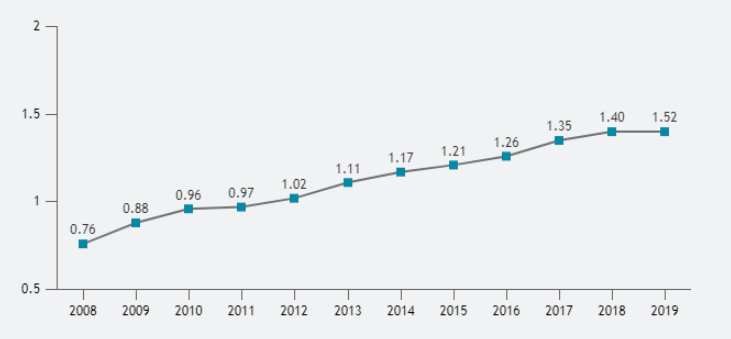

Growth of High Net Worth Individuals

As the alternative asset market has grown, so has the number of HNW individuals. According to Spectrem Group, the number of HNW households in the U.S. rose from roughly 760,000 in 2008 to over 1.5 million in 2019.

Source: Spectrem Group, 2020

Global Alternatives AUM ($ in trillions)

59% AUM Growth in Global

Alternatives Projected by 2023

Alternative investments are forecast to continue becoming a bigger piece of the overall investing landscape. By 2023, Preqin estimates the alternative asset space will reach $14 trillion.

Source: Preqin, 2017

Source: Preqin, 2017

Yet, as the growth of alternatives has proliferated, most investors still face very real and significant challenges to obtaining liquidity for their professionally managed alternative investments. Ben is in a unique position to provide liquidity solutions for alternative asset holders. Ben, acting as principal, can use its balance sheet to provide liquidity directly to HNW individuals and small-to-mid-sized institutions looking to monetize their illiquid alternative investments, and aims to deliver this liquidity at or near Net Asset Value (NAV)-unlike other secondary liquidity providers that rely on large discounts to NAV to make a profit.

To learn more, download the complete white paper, “Tapping the Liquidity Locked in Alternative Assets,” by Brad K. Heppner, Founder and CEO, Ben.