Ben was formed to serve the unmet need for liquidity for mid-to-high net worth individuals and small-to-mid-sized institutions who are locked into long-term alternative asset investments. We are designed to provide liquidity for most types of professionally managed alternative asset investments, including:

- Private equity

- Venture capital

- Leveraged buyouts

- Special situations/structured credit

- Private debt

- Real estate

- Feeder funds

- Fund of funds

- Life insurance policies

- Natural resources

- Non-traded BDCs

- Non-traded REITs

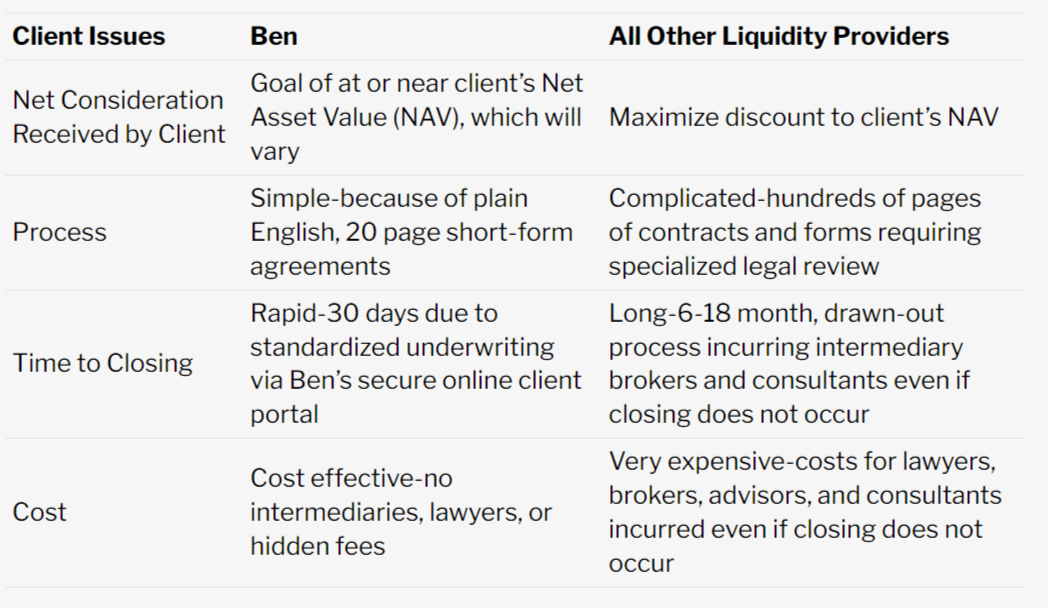

- Client Issues Ben

Client identifies need for liquidity from their alternative asset. Ben offers a range of liquidity solutions

Client provides documentation through a safe and secure online portal to Ben. Ben underwrites and presents simplified terms and product documents.

Client places all or part of the alternative asset into custody with Ben’s ExAlt Plan Custody Trust.

Client receives consideration of cash, equity or debt securities issued by a registered public Nasdaq exchange-traded company or an affiliate thereof based on the Ben liquidity solution selected.

To learn more, download the complete white paper, “Tapping the Liquidity Locked in Alternative Assets,” by Brad K. Heppner, Founder and CEO, Ben.