This article is the second in a series drawn from Ben’s latest global macroeconomic outlook, Geographic Diversification in Private Equity Markets, developed and written in partnership with Oxford Economics.

In the first part of our series, we took a broad look at how the private markets landscape is adapting to a wide range of shifting global conditions. This article builds on that earlier conversation by taking a more in-depth look at how geography impacts private markets and why that should matter to investors seeking to diversify their portfolio. To better understand what geographical diversification might look like, we consider private equity over the next five years across six key global regions and develop baseline forecasts for two key drivers of equity returns, GDP and inflation.

Global GDP Recovery Remains Uneven

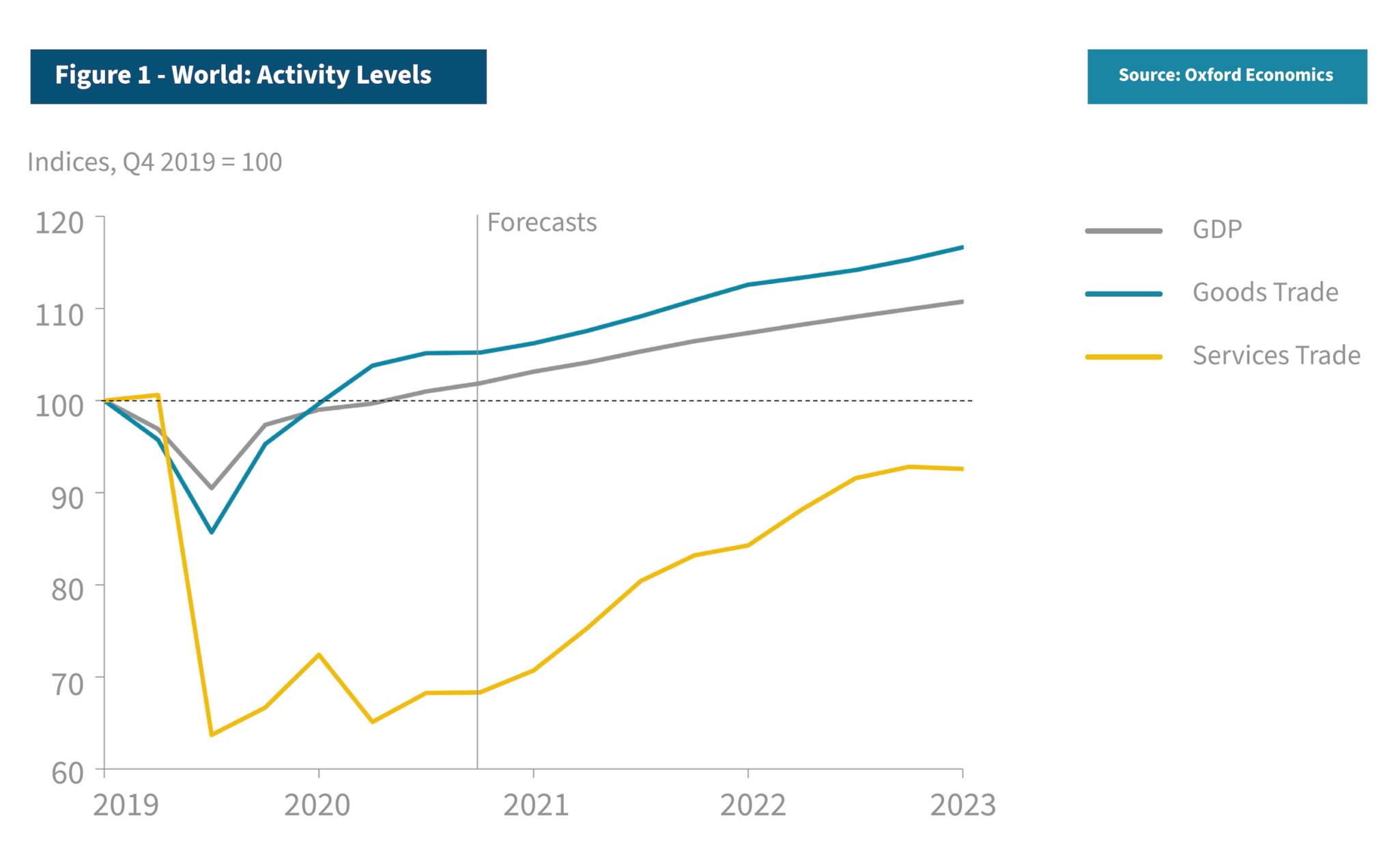

The world economy regained its pre-pandemic size in Q2 2021 and we expect it to continue to grow robustly in the near term, with world GDP rising 5.7% in 2021 and 3.8% in 2022. Importantly, though, the global economic rebound will be uneven (Figure 1).

Globally, rates of vaccination against COVID-19 and the lifting of pandemic restrictions are uneven. As a result, some economies will grow much faster than others. Future waves of coronavirus infections continue to pose challenges for economies with low levels of immunity and/or vaccination, where restrictions may have to remain in place for some time. Lingering restrictions have already caused world services activity to rebound more slowly than production and trade in goods. Sectors such as travel and transport continue to operate well below capacity, and we do not expect world trade in services to return to pre-pandemic levels until 2025 (Figure 1). This has obvious negative consequences for economies specialized in tourism.

Projected Growth by Region

Projected Growth by Region

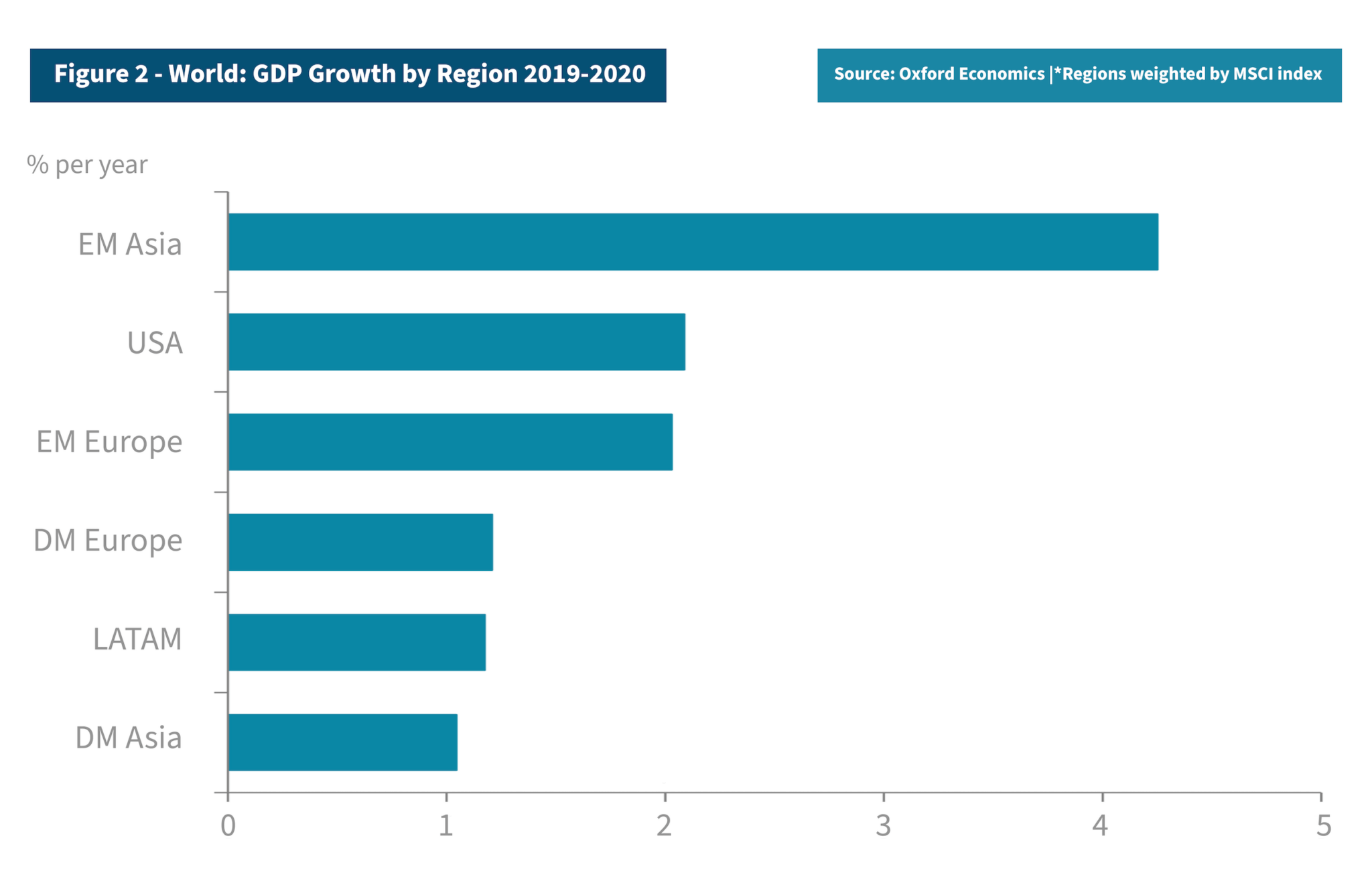

In terms of geographic regions, we expect EM Asia to remain the fastest growing area from 2019-2024, expanding by just over 4% per year (Figure 2). Within this, Chinese growth is forecast at around 5% per year. The U.S. is expected to expand by 1.9% per year, thanks in part to large scale fiscal stimulus. DM Europe is expected to lag well behind, growing just 1.1% per year, reflecting more restrained macroeconomic policies and various structural drags. Growth in DM Asia is expected to be a little slower still, dominated by slow growth in Japan where the demographic drag remains powerful and capex growth slow.

Among other emerging markets, EM Europe is forecast to grow 2% per year while LATAM is the weakest performer with growth expected at just 1.2% per year. This weak performance reflects the fact that LATAM has been especially hard-hit by the coronavirus pandemic as well as various other headwinds in individual economies such as lagging reforms, fiscal austerity, macroeconomic instability and a debt overhang.

Inflation Risk in Advanced and Emerging Economies

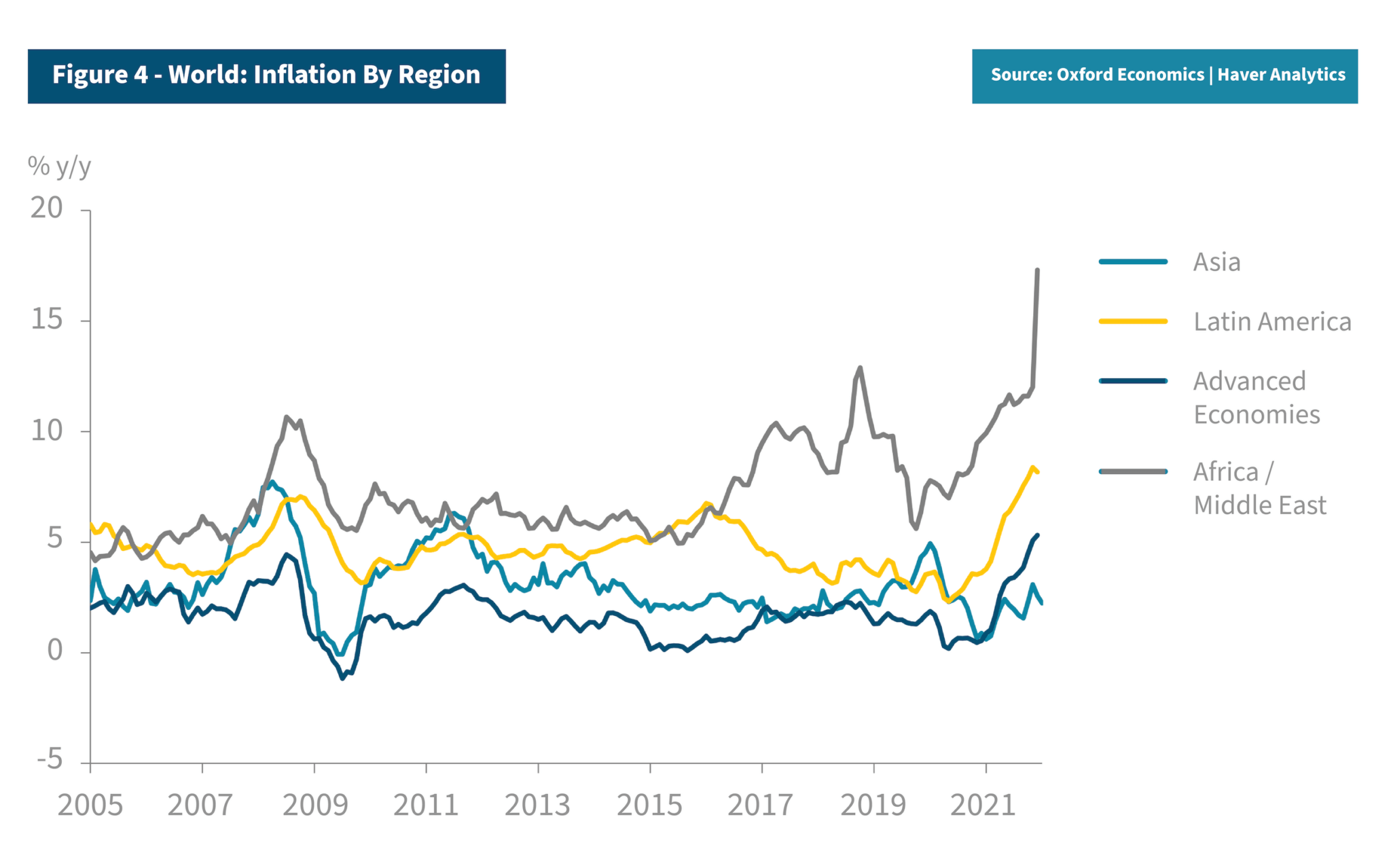

Global inflation is expected to run a bit hotter in the near-term due to the impact of rising fuel prices, economic reopening and strong macroeconomic stimulus policies in some economies-most notably the U.S. From 2021-2025 we expect inflation in the advanced economies at 2.5% per year versus 1.3% in the previous five years; for the U.S. we see inflation at 3.4% per year versus 1.8% in 2016-2020.

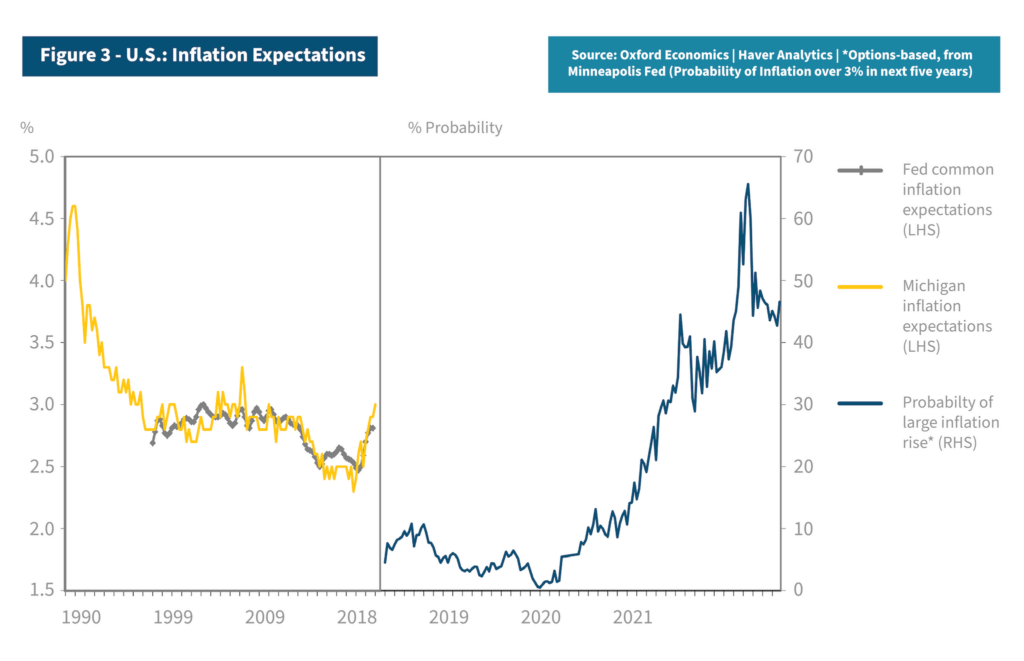

Inflationary pressures have already been substantial this year, but some economies are better placed to manage them than others. In the advanced economies, the accumulated anti-inflation credibility of central banks and resultant well-anchored long-term inflation expectations are key factors that explain why we do not expect the recent rise in inflation rates to persist or accelerate into the long-term.

Nevertheless, upside risks to inflation do exist in the advanced economies, as illustrated by some market-based measures of inflation expectations (Figure 3). This shows a notable increase in the probability of a big rise in inflation for the next five years. The danger is that high headline inflation, large budget deficits and perhaps some slippage in central bank resolve might dislodge long-term inflation expectations. We think the probability of such an outcome is around 10%, rising to 15% in the U.S.

For emerging economies, inflation risks are more elevated. Already, inflation has risen much further than in the advanced economies in some regions, notably Africa/Middle East and Latin America (Figure 4). Economies in these regions generally lack the long record of successful anti-inflation policy of most advanced economies, making it harder to contain price pressures.

The case for geographical diversification is a nuanced one. Exchange rate risk can also be an issue for investors interested in geographical diversification given the dollar’s tendency to move in large swings, sometimes rapidly. But for those investors with good market access and strong risk management capabilities, the value-add of foreign allocations far exceed their additional risks and management complexity.

Trust Ben™

At Ben, we have crafted a suite of reliable, ongoing liquidity solutions for investors in alternative assets. Our process seeks to give investors access to hard-earned investment capital, with liquidity provided from our own balance sheet. Contact us today to schedule a consultation with our expert team.

The information in this material is not intended to replace any information or consultation provided by a financial advisor or other professional nor shall be perceived to constitute financial, legal, accounting or tax advice.

The views and opinions expressed are those of the panelists and do not necessarily reflect the official policy or position of Ben or Oxford Economics. The information in this material is not intended to replace any information or consultation provided by a financial advisor or other professional nor shall be perceived to constitute financial, legal, accounting or tax advice.

These materials contain certain estimates, projections and forward-looking statements that contain substantial risks and uncertainties. The estimates, projections and forward-looking statements contained herein may or may not be realized, accurate or complete, and differences between estimated results and those realized may be material. Such estimates, projections and forward-looking statements are illustrative only and reflect various assumptions of Ben’s management concerning the future performance of Ben and its affiliates, and are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Ben’s control.

Except as otherwise noted, the materials speak as of January 2022. Neither Ben nor any of its affiliates or representatives undertakes any obligation to update or revise any of the information contained herein or to correct any inaccuracies which may become apparent.

Download the full Geographic Diversification in Private Equity Markets white paper above or contact us today to discuss what Ben’s secondary market liquidity solutions could mean for you.

CONTACT INFO

CALL: 888.887.8786

EMAIL: askben@beneficient.com