In an August 2022 update to our annual global macroeconomic outlook, The Beneficient Company Group, L.P. and Oxford Economics finds the U.S. economy could remain resilient in the face of currently forecasted federal interest rate hikes.

Summary

The fast acceleration of inflation through H1 2022 and the broadening of inflationary pressures have led most central banks to reverse course on their ultra-accommodative policy stance. Broader concerns about stagflation therefore don’t seem likely. However, in this cycle, much will also hinge on how markets react to quantitative tightening. While our analysis suggests that much of the Fed’s remaining rate hikes have already been priced-in by markets, the same conclusion does not hold for its quantitative tightening program.

Whether a long-lasting recession can be avoided will depend on how persistent U.S. inflation turns out to be in face of planned tightening for 2022, but we still believe the U.S. economy to be sufficiently resilient to withstand currently projected rate hikes. In this mid-year follow-up, we analyze current economic trends and provide an update on the market views shared earlier this year in our whitepaper, Geographic Diversification in Private Equity Markets. Click the “Download the Update” button to the right to learn more about:

Macroeconomic Outlook

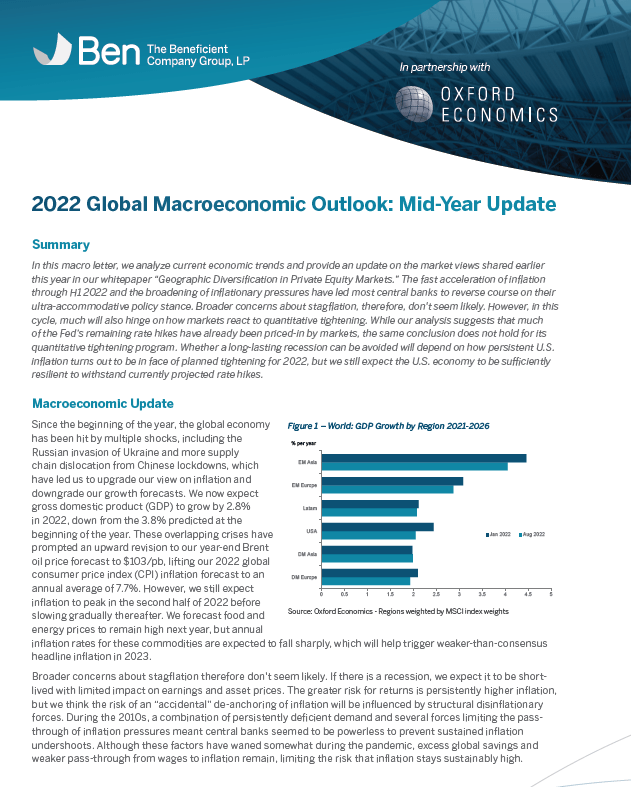

The global economy has been hit by multiple shocks since the beginning of the year, including the Russian invasion of Ukraine and more supply chain dislocation from Chinese lockdowns, which have led us to upgrade our view on inflation and downgrade our growth forecasts.

Public Markets

After the sharp market correction in H1 2022, equities have the potential to bounce back assuming valuations have room to improve and the discount rate shock proves fleeting.

Private Markets

While we still believe relatively good risk/reward tradeoffs to be broadly available in U.S. private markets, we recently updated our North American allocation tilt from “‘bullish”‘ to “‘neutral”‘ due to a number of factors, such as the potential impact of higher rates on leveraged buyouts.

Disclaimers

These materials are provided for illustration and discussion purposes and are not intended to be and do not constitute financial, tax, legal or investment advice or recommendations, or an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities. Any offer, sale or exchange involving securities of Beneficient, a Nevada corporation., and/or any of its affiliates, subsidiaries and successors (collectively, “Ben”) may be made only to qualified, eligible customers or investors and solely pursuant to applicable definitive agreements and documents, such as a confidential private placement memorandum, subscription agreement, purchase agreement or similar documents (collectively, “Definitive Documents”). These materials are not intended for, and do not take into account the particular business, investment or other objectives or financial circumstances of, any specific customer or investor or type of customer or investor. Investments involve risks and are not suitable for all persons.

Certain information has been provided by and/or is based on third party sources. Although believed to be reliable, the accuracy, completeness and timeliness of such information, including any underlying assumptions, has not been independently verified by Ben. Any opinions, statements or the like (collectively, “Statements”) regarding future events or which are forward-looking, including any targets or targeted goals, are for illustrative purposes, are based upon available information including third party information, and constitute or reflect only current subjective views, beliefs, outlooks, goals, assumptions, estimates or intentions, including business strategies, anticipated future plans and business financial projections of Ben, should not be relied on, are subject to change without notice due to a variety of factors, including decisions made by Ben management, fluctuating operating results, and business, economic, competitive and market conditions and factors, and involve inherent risks, changes and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Ben’s control. Any performance targets or objectives should not be relied upon as an indication of actual or promised future performance, which will fluctuate, including over short periods, and are only intended as a guideline to help evaluate an investment or program participation’s strategies and features along with any benchmarks or indices shown. Statements may be based upon underlying assumptions and analyses made by Ben or third parties. Future evidence and actual results could differ materially from those set forth in, contemplated by, or underlying these Statements and third-party information, and even if realized may not result in the expected results to, or have the expected effects on, Ben, any investment, or program participation. In light of these risks and uncertainties, there can be no assurance and no representation is given that these Statements are now, or will prove to be, accurate, realized or complete in any way. Ben does not undertake any obligation to revise or update these Statements, including to reflect events or circumstances after such date or to reflect the occurrence of unanticipated events.

Securities brokerage services are offered through AltAccess Securities Company L.P. (“AltAccess Securities”), which may provide certain materials to recipients. AltAccess Securities is affiliated with Beneficient and/or any of its affiliates, subsidiaries and successors (collectively, “Ben”) and is a broker-dealer registered with the Securities and Exchange Commission and various states and a Member FINRA/SIPC.

For informational purposes only.